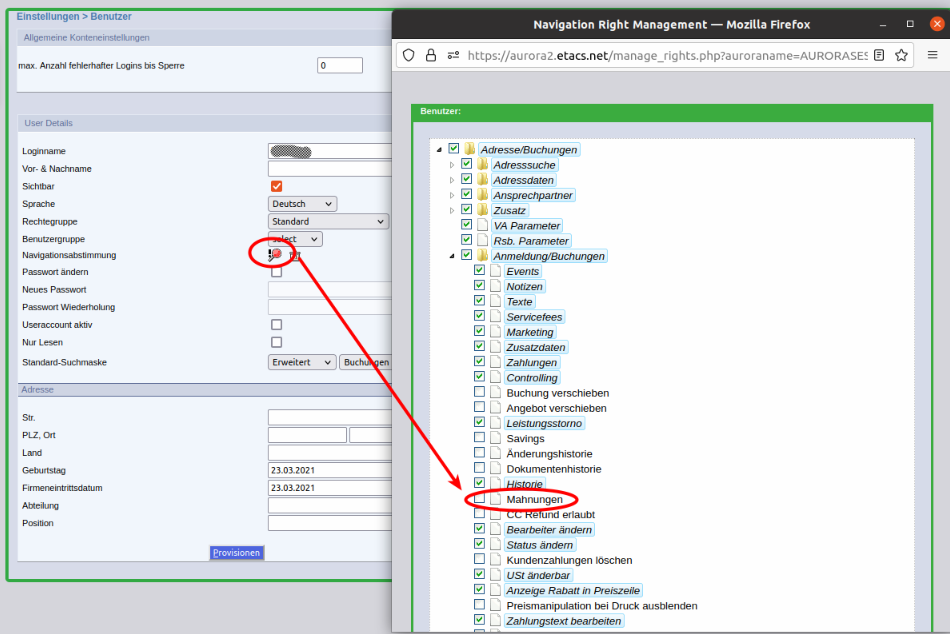

You can now generate dunnings directly from the booking. For this a user right must be set:

Main menu: Administration > User

Red magnifying glass (click opens window)

Address/bookings > Address/Registration

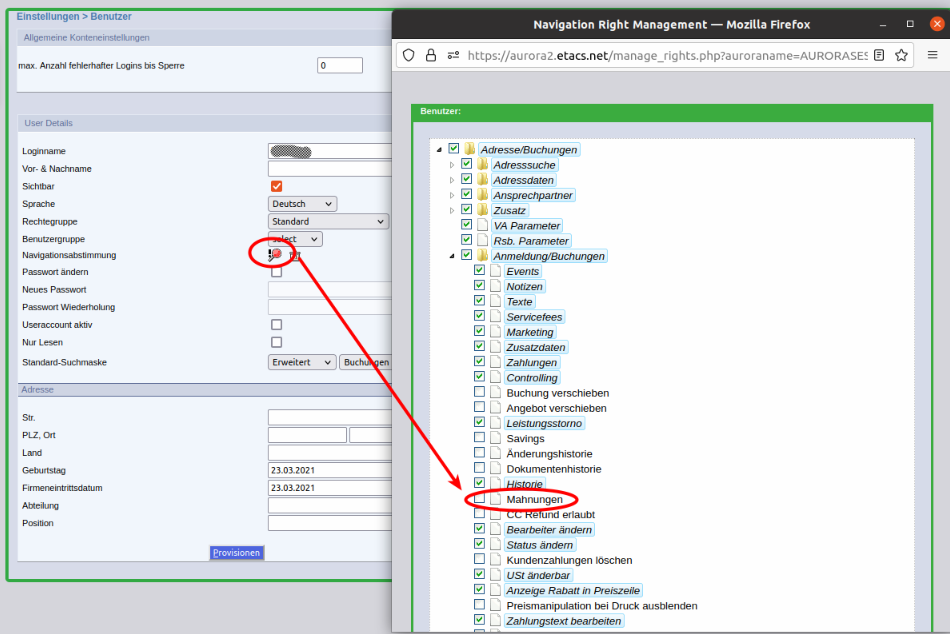

You can now generate dunnings directly from the booking. For this a user right must be set:

Main menu: Administration > User

Red magnifying glass (click opens window)

Address/bookings > Address/Registration

To be found in the bookings as well as at the customer – here all outgoing emails to a booking or customer are stored in Etacs.

If you have any questions, please contact the Etacs support.

Email text modules can also be saved there as a template using the placeholders provided. A saved template cannot be deleted, but can be renamed and overwritten.

If you have any questions, please contact the Etacs support.

Since the beginning of July 2022 you can upload documents (pdf, jpg, png) in the customer master data. You can access the “Document history” via the “Documents” tab. At the top left you will find the “Create new upload” button. Please always assign an “Upload title”. Another new feature is that all entries can be deleted via the dustbin icon. The authorisation results from the user right “Delete documents”. If you have any questions, please contact Etacs Support.

Amadeus will phase out VERK on 30.06.21. This interface was used to import Amadeus Rail. ETACS will offer a new interface called BIR starting 01.07. , The data delivery has to be requested from Amadeus.

As of today ETACS offers the possibility to mark a price line as taxable but with the add on (marge). This functionality suppresses the VAT on all pdf documents and is needed because of a change to the margin taxation mandated by the EU. Please consult your tax laywer for further questions. The accounting side will correctly report the VAT chosen, only the PDF documents will show 0% VAT. Airplus transactions will follow in the coming days.

The Brexit can mean differences to the tax regime of your service fees for travel after 01.01.2021. For a limited period of time ETACS will offer both EU and third country fees for B2B customers in the UK. Pleas consult your accounting or your tax laywer which fee to chose.

Starting 06.04.2017 Etacs will provide a new dynamic report under “Reporting -> Dynamic report”.

With this new feature you can search either customers, bookings or services and add them to a “shopping basket”. That shopping basket can then be handed over to the other reporting types or exported to .csv.